Asian markets showed a strong rally in Tokyo despite a slump in Wall Street, reflecting resilience amid ongoing US tariff pressures. Investors appeared optimistic about regional growth prospects and were undeterred by global trade tensions.

Market Performance Highlights

The Tokyo stock market led gains with key indices advancing significantly. Other major Asian markets in Hong Kong, Seoul, and Shanghai also recorded positive movements. This rally contrasts with a downturn seen on US exchanges, where concerns about tariffs and trade negotiations weighed heavily on investor sentiment.

Factors Driving the Rally

Several factors contributed to this recovery in Asian equities:

- Strong corporate earnings in key sectors such as technology and manufacturing.

- Supportive government policies aimed at boosting economic growth and investor confidence.

- Reduced concerns over a full-scale trade war despite the recent tariff announcements by the US.

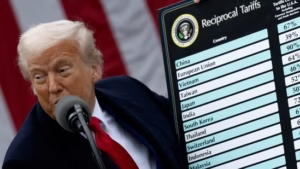

US Tariff Pressure Impact

Despite the optimism in Asia, the impact of US tariffs remains a significant risk factor. The tariffs have raised concerns about global supply chains and potential increases in costs for manufacturers and consumers. Market watchers continue to monitor negotiations closely to gauge the potential for escalation or resolution.

Outlook

Investors are expected to stay cautious yet hopeful as the situation develops. The ability of Asian markets to weather external shocks and maintain momentum will be critical in shaping the region’s economic trajectory in the coming months.

Average Rating